Choosing the right accounting software for your small business is not an easy task. There are so many different options to choose from, each with their own strengths and weaknesses. It can be hard to know where to start when you’re just getting started in business. With that being said, we have compiled a list of the best accounting software available today based on all of these factors- what they offer, how much they cost, ease of use etc. We hope this helps make your decision easier.

We tested more than 100 accounting software applications to help you choose the best one for your company. We sought for cost-effective, user-friendly accounting programs with time-saving features such as automated bank feeds, automatic payment reminders, and online invoicing and payment acceptance. We also looked for programs that provided comprehensive real-time financial reporting.

SAGE ACCOUNTING SOFTWARE

Sage 50cloud Accounting is a robust small business accounting application with comprehensive financial tools and generous customization options. Its integration with Microsoft 365 makes it a hybrid solution: local, hard drive-based software that can share data with productivity applications via the cloud. Sage 50cloud Accounting offers many features to help you run your business more efficiently. It also comes at an affordable price for those who want to avoid expensive upfront costs of other solutions on the market today.

Sage 50cloud Accounting is a huge small business accounting program that’s designed for computer use. It’s the most complete, configurable accounting software I’ve seen, although it does more than enough for many small businesses and costs a little more. Its integration with Microsoft 365 sets it apart from the competition, aside from its broad feature array.The main thing to understand about this powerful and inventive link is that you need Sage 50cloud Accounting on a local desktop (or a decent laptop, since it’s resource-intensive) to get the most out of its capabilities, although some of its data may be retrieved remotely. Sage 50cloud Accounting is inferior to the other accounting applications in that it is only accessible on Windows machines, which limits its appeal.

Sage 50cloud Accounting is more complex in certain ways than even the most advanced of low-cost accounting websites. However, because of its strength and the cost of membership, it may be less appealing to small and simple businesses. It’s best for firms that require more sophisticated features and customization, aren’t scared of desktop software, and whose remote staff have their own installations of the program so they can exchange company data via Sage’s Remote Data Access. For small companies, we have two Editors’ Choice winners in the field of small business accounting software. Intuit QuickBooks Online is the best option for a large number of US firms, while FreshBooks is ideal for very tiny enterprises like solo entrepreneurs and freelancers.

How Much Does Sage 50cloud Accounting Cost?

The Sage 50cloud Accounting line consists of three plans, each with two pricing tiers. For one person, Pro Accounting costs $56.08 per month. Premium Accounting is available for single users at a price of $87.58 per month, while Quantum Accounting is accessible for people at a cost of $1,460 yearly. If you pay for 12 months in advance, you receive a 10% discount on the Pro and Premium plans. The yearly cost of integrating Microsoft 365 Business with iRent rooms is $150 per plan. All plans come with a one-year contract, and all are set to renew automatically each year.

Premium Accounting allows you to keep track of billing, collections, and invoices for your customers. It also has a comprehensive inventory tracking system, integrated payroll, and reports. Premium Accounting offers more features than other solutions, including specialized capabilities and advanced budgeting and job costing. Quantum Accounting is the most sophisticated accounting software available because it includes extra capabilities such as multi-company access and role-based security.

Other accounting software, such as Intuit’s QuickBooks Premier Plus and Xero, are similarly priced to Sage 50cloud Accounting’s fees. In certain circumstances, they’re less expensive. For instance, Annual customer support is included with QuickBooks Premier Plus at $549.99 per year (phone service is optional).

MELIO

Many small business owners do not require the use of complicated accounting software. If you only need to send invoices and receive payments, Melio is a good option. Because you can create and accept payments, manage debts, and integrate with QuickBooks for free using this free accounts payable solution, we decided to include it as one of our top picks.

There is a 2.9 percent charge for paying by credit card with this cloud-based system, but there is no cost to make payments through a bank transfer. It’s free to take payments from clients by cheque or bank transfer.

Melio is also simple to operate. It takes only a few minutes to add vendors to pay and set up payments. You can manually enter a vendor’s data, attach a file with the date on it, or take a picture of an invoice with Melio. You may invite both internal users and accountants to utilize the program, then define roles and permissions so you know who is viewing your data and what they’re doing with it at all times.

We also appreciate that Melio allows you to better manage your cash flow. You may set approval limits on transactions, which will prevent you from falling behind or having a cash flow problem owing to paying an invoice early.Another reason Melio was chosen as the best accounts payable software is that it is compatible with QuickBooks, which is our top pick for small enterprises. Melio is great whether used alone or together with QuickBooks, since it integrates well and provides even more insight into your cash flow. The two-way synchronization happens quickly and easily through the integration.

Melio may not be suitable for larger organizations that need a lot of sophisticated accounting features. However, for small businesses that only need to track accounts payable, Melio should be considered.

ZOHO BOOKS

Zoho Books is a simple accounting software for small businesses. Zoho Books offers all of the fundamental features that microcompanies need, as well as more advanced tools such as project billing and time recording.

It also has connections so you can use it alongside other programs. We picked Zoho Books as the finest accounting software for small businesses due to its simplicity and value.

Zoho Books, a cloud-based accounting software that makes it easy for small and medium-sized businesses to send invoices and keep track of their finances on the go, has apps for Apple iOS, Android, and Windows mobile devices. There are even dedicated smartwatch apps. As soon as you’re finished working on something, you may bill.

When you use basic accounting software, you don’t want an out-of-date user interface or functions that are so rudimentary you can’t get significant business insights from the data. That is why Zoho Books distinguishes itself: while the platform is simple to navigate, it does not lack functionality, and the user experience is modern and elegant. It can also speed up many business processes via automation, which is a nice time-saving feature.

Zoho Books provides a number of features that enable you to track your customers, generate statements, and bill them automatically. You may set recurring invoices and send automatic payment reminders, and if you link your payment processor with Zoho Books, you can accept payments in invoices. Automating reporting is also possible.

Zoho Books‘ client portal, a website where clients may see invoices, make comments, and pay online, is another distinction from the competition. This is an especially valuable feature for firms that work closely with their customers on projects since it allows them to get feedback from their consumers. You can create the portal to enable your customers to evaluate you.

Zoho also offers its own line of integrated business applications, including customer relationship management (CRM) software, email marketing and social media marketing solutions, spreadsheet editors, and other productivity tools. Zoho Books is comparable to competitors in that it works with third-party productivity apps and business solutions such as Google apps, the Square point-of-sale It also has a Zapier integration, allowing you to connect it to more than 1,000 third-party apps. Zoho Books is our preferred accounting software for microbusinesses because of all the tools and services on offer.

FINANCEPAL REVIEW 2022

FinancePal is a cloud-based accounting, bookkeeping, and payroll software solution designed for smaller to mid-sized enterprises. The company’s main goal is to remove much of what may be daunting and complicated about being an entrepreneur from business owners’ hands so that they can focus on other things.The program is simple to use and highly adaptable. Simply utilize the bookkeeping services, add accounting tools, or offer extensive payroll assistance as needed, and plan prices will differ based on the services utilized.

FinancePal uses double-entry accounting, as it claims it is more effective and accurate for complex bookkeeping needs.

What makes FinancePal so distinctive is that, once you’ve joined up, you’ll have access to a team of specialists that include accountants, financial experts, and tax lawyers who can assist you with many of your inquiries and take tedious duties off your plate. For people who are weary of back-end accounting matters or complex tax issues, this might be very beneficial. FinancePal connects with QuickBooks, TSheets, and Gusto to provide a full end-to-end service.

You may access and modify all of your data from anywhere in the world thanks to the cloud-based architecture. This procedure is also made easier thanks to a free mobile app offered by the firm.

Pricing

FinancePal is a finance service that works on a quote-based or à la carte system customised to your company. Customers pay for only the services they require, according to FinancePal, thanks to this pricing structure. While we usually prefer straightforward, upfront pricing without the need to speak with a sales agent before receiving concrete figures, FinancePal’s website deserves some praise here. You can complete a few basic questions about your company and accounting and payroll needs, and you’ll receive an estimate that will at the very least get you in the ballpark of what to anticipate after you join.

For smaller firms without a huge payroll, I discovered that you will usually spend between $150 and $350 each month after playing with the quote calculator and making a few phone calls.

Even much larger businesses can get just FinancePal’s bookkeeping services for under $400 a month, and that includes:

- A dedicated account manager

- Account reconciliations

- Monthly and EOY financial statements

- Mobile receipt tracker

Features

Although FinancePal has a team of professionals that will take care of much of the work for you, it also provides a variety of services including accounting and bookkeeping, as well as only charging for what you require. Payroll and small company tax solutions are also available through FinancePal. Here are some facts about where FinancePal shines.

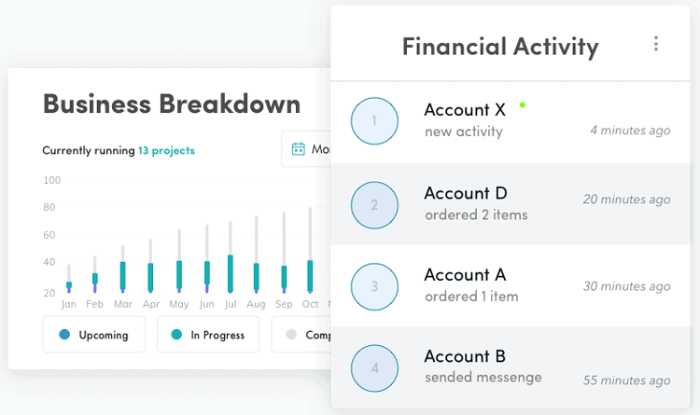

- Dashboard: Accounts payable and receivable can be handled with just a few clicks in the dashboard. It’s simple to connect with other accounting software for small businesses (such as QuickBooks), so you can keep all of your records up to date.

- Invoicing: The payroll service allows you to invoice online and customize how often to conduct your payroll.

- Expense Tracking: FinancePal keeps track of your expenses using mobile receipts and, through its third-party staff, manages your company’s daily expenditure.

- Bank Reconciliation: There are tax and financial experts on hand to assist you with any outstanding issues or reconciliations with your bank.

- Accounts Payable: FinancePal has a tool that takes invoice data and automatically enters it into your accounting software. Manual review systems make it simple to identify any omissions, and its accessible platform allows you to view accounts from anywhere with an internet connection.

- Payroll: FinancePal specializes in providing online payroll services. Again, its staff of professionals can take care of the majority of your requirements while also allowing you to tailor the service to your own specific needs.Both the personnel and financial administration functions are handled by your company’s HR department. They check employee records, issue employment contracts and perform payroll processing. You have complete access to the payroll dashboard, which is maintained by FinancePal using automated data gathering. This also covers time sheets, invoices, and account analysis.

- Reports: FinancePal provides a number of reports that may be viewed through its mobile app in real time to keep track of your money.

- Sales Tax & Tax Support: FinancePal’s consulting staff and tax experts ensure that you’re in compliance with both retail and eCommerce taxes.

HONEYBOOK REVIEW 2022

HoneyBook is a cloud-based customer relationship management (CRM) system for small businesses. Users may track business activities from beginning to end using the solution, which includes project management, scheduling clients, writing contracts online, sending invoices, and collecting payments.

HoneyBook offers project management with task tracking that allows users to see and monitor the progress of a job. Users may keep bills, contracts, and other papers in one location. Users can utilize personalized templates and notifications to respond to clients and follow up on appointments automatically. Automated payment reminders can also be sent, as well as task reminders based on the project.

HoneyBook works with QuickBooks, Calendly, Zapier, Gmail and Google Calendar to connect with other apps. HoneyBook offers a monthly subscription for its services. A mobile application for Android and iOS users is available, as well as support through email, an online help center, a community forum, and over the phone.

Pricing

Starter Plan: $9 per month, no annual billing option. Unlimited Plan: $39 per month, or billed annually at $390 (a $78/year savings!)

QUICKBOOKS

What is QuickBooks’ advantage over other accounting programs? The popular accounting software is utilized by small companies all across the country. Accountants are quick to compliment the program for its low cost, simplicity of use, and efficacy. Finding many flaws with QuickBooks may be difficult, especially considering today’s small business needs.Small business owners who want an accounting solution that integrates with a variety of company applications and isn’t expensive should check out QuickBooks Online. Many organizations find it useful to connect their credit card processing provider to their accounting package to complete the circle on their sales. The fact that the program is cloud-based and updated on a regular basis is something we appreciate.

QuickBooks Online was our top pick for small businesses because we believe it is the most user-friendly, secure, and cost-effective accounting software available. You can produce professional invoices, take payments, manage expenditures, and track receipts with this accounting program. That’s just on the Basic plan; higher-priced plans include batch invoicing, advanced analytics, and even a dedicated accounting department. QuickBooks Online links with a variety of popular business tools, including Bill.com, Salesforce, and HubSpot.

Thanks to QuickBooks’ built-in reports, you won’t have to build financial reports from the ground up. The trial balance, general ledger, and 1099 transaction detail reports are all included in the software and will be required at tax time.QuickBooks lets you save reports for later reference and email them to yourself. You can also have the program run and send reports to you automatically, with the option to schedule them for a certain time of day or frequency, such as daily, weekly, monthly, or quarterly. QuickBooks has some of the most effective reporting features among accounting programs we looked at.

QuickBooks Online’s flexibility is another strength. Whether you’re a do-it-yourselfer or want to hire someone to help, QuickBooks provides. You may get assistance from a bookkeeper who will set up your program, categorize transactions, reconcile your accounts, and close your books monthly and yearly with its Live Bookkeeping service. Finally, as a customer, you don’t have to pay for services you don’t require; the fee for Live Bookkeeping is determined by your requirements.

It’s simple to work with QuickBooks if you already have an accountant. The software allows you to provide your accountant access for free; all they have to do is accept the invitation. You may cancel access at any time. Without breaking the budget, QuickBooks provides a slew of accounting capabilities that are popular among small companies.

QuickBooks has just introduced a new payment device that allows small companies to take card payments on the go. QuickBooks Payments is compatible with the tiny contactless card reader. In response to a change in how small firms pay, the firm claims that this new gadget was created.Intuit has revealed that it is buying Mailchimp, the marketing platform used by millions of small and medium-sized businesses. The accounting software maker plans to link data from Mailchimp with QuickBooks so clients can take action. The acquisition helps Intuit meet a mission to provide small businesses the digital resources they need to thrive.

Intuit has introduced a new DocuSign function for QuickBooks that allows small companies to sign bids right on the internet. The DocuSign eSignature Connector reduces the time it takes to send estimates and lets you monitor their progress.

The ability to invoice and compute expenses in real time, as well as track expenses using the mobile app or desktop software, is a key feature of QuickBooks Online. Dicyt is an AI-powered tool that lets business owners pay bills, manage expenditures, save receipts, and generate reports from one place. Docyt’s connection with QuickBooks helps businesses limit the number of applications they need to manage their finances.